Expert Financial Advice You Can Trust

Everything starts with listening and turning understanding into a clear path forward. With this in mind, we run a financial advisory practice in downtown Toronto. We’re pleased to work for family offices, trusts, business owners, professionals and their families.

Our aim is to help our clients grow their wealth, generate income and protect their interests in a tax efficient manner.

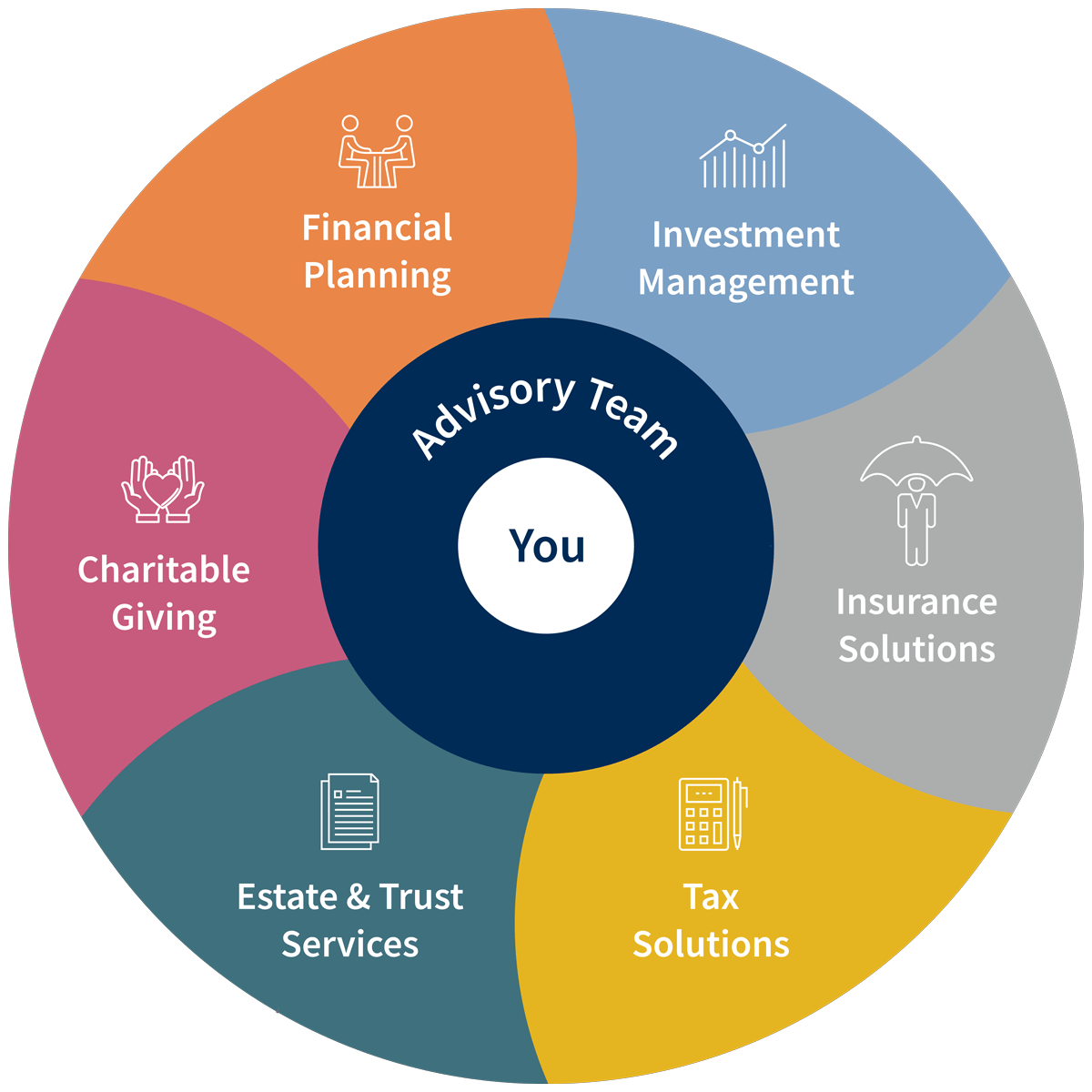

At JB Wealth, we offer an array of personalized services, total wealth solutions and expert advice that can help make a positive difference in the pursuit of your financial goals. Whether you’re currently in retirement, preparing for the next chapter in your life, or just starting out - our team will build a financial plan that addresses your individual needs and financial goals.

Are you Retirement Ready?

Your success in retirement depends on the planning you do today. No matter what stage you are at now, we have the Total Wealth Solutions to help you achieve your financial goals and build your legacy.

Who We Work With

Information & insight